discover & Fix Hidden Payroll Mistakes & Compliance Issues in Just One Hour!

Discover What Your Payroll Checklist Didn’t Reveal—Before It’s Too Late! You’ve taken the first step with the checklist, but what about the deeper, hidden issues that could cost your business thousands? In this exclusive, One-on-One, Free Payroll Strategy Session, we’ll go beyond the basics to uncover the overlooked pitfalls and compliance gaps silently draining your profits and help you fix them.

(Act Now! Just (2 Spots Left) with (4 People) Currently Viewing!)

🔒 100% privacy, No Game, No spam.

Updated: 26th of June 2025

Let’s face it—managing payroll in Kenya isn’t always smooth sailing. It feels like a never-ending treadmill: every month, the same cycle, the same uncertainties, and the constant fear of missing something crucial.

Does this sound familiar?

You’re working tirelessly, yet you’re constantly second-guessing your compliance, dealing with errors, or fearing hefty fines. You’ve tried to streamline things, but somehow, there’s always a loose end that leaves you anxious and drained.

You’re not alone.

Many Kenyan businesses—just like yours—feel trapped in a system they can’t fully control. They’re putting in the effort, but compliance gaps, hidden mistakes, and outdated processes are holding them back.

But here’s the good news: you don’t have to stay stuck.

There’s a better way. A proven strategy to uncover and fix those hidden payroll pitfalls, eliminate compliance stress, and give you peace of mind. We’ve helped others just like you simplify their processes, save money, and regain control.

Now, it’s your turn.

Are you ready to uncover what’s really holding you back? Ready to transform your payroll process into one that works for you, not against you?

Book your free Payroll Strategy Session today, and let us guide you through a clear, actionable plan to fix the gaps, streamline your process, and keep your business compliant.

It’s time to break free and move forward. Let’s get started.

The Hard Truth About Payroll Compliance in Kenya

We’ve uncovered some eye-opening realities about the struggles Kenyan businesses face with their payroll systems. Let’s break it down:

Hidden Compliance Gaps: Over 60% of businesses unintentionally overlook critical payroll regulations, exposing themselves to penalties and audits. These gaps often stem from outdated processes or misinterpreting ever-changing rules.

Costly Errors: Nearly 30% of businesses lose money each year due to payroll errors like overpayments, missed deductions, or inaccurate tax filings. Small mistakes quickly add up, draining valuable resources.

Time Drain: Payroll management consumes an average of 10-15 hours per month for business owners and HR teams. That’s time that could be spent growing your business instead of wrestling with numbers.

Employee Trust Issues: Late payments or inaccurate payslips erode employee confidence. Almost 40% of workers report frustrations with payroll mistakes that directly impact their financial planning.

Inconsistent Systems: Many businesses struggle with fragmented systems—manual spreadsheets, multiple software platforms, or inadequate tools—that increase the risk of compliance lapses.

But here’s the good news: it doesn’t have to be this way.

There’s a better approach to payroll—one that ensures compliance, eliminates errors, and saves you time and money.

Your Opportunity to Get It Right

Imagine uncovering these hidden gaps and fixing them before they cost you even more. With our Free Payroll Strategy Session, we’ll take a deep dive into your current payroll system, identify issues, and show you how to fix them efficiently.

We’ve already helped countless businesses across Kenya streamline their payroll processes, ensure compliance, and regain peace of mind.

The first step? It’s simple.

Click below to book your session now and discover how to turn payroll challenges into opportunities for growth.

Don’t let payroll issues hold your business back—act today.

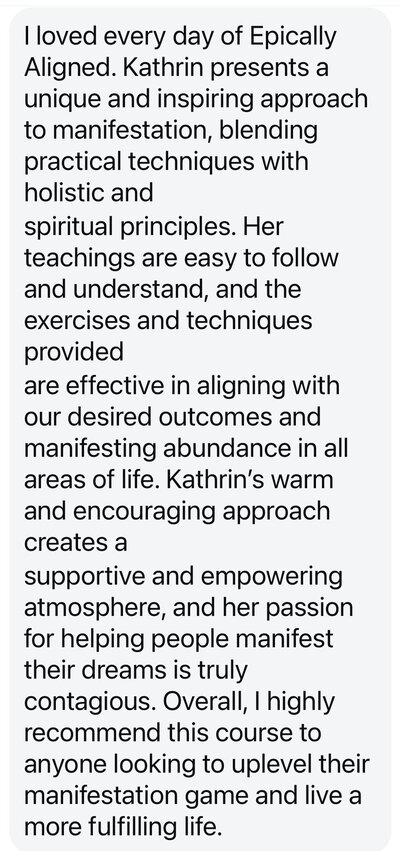

⭐⭐⭐⭐⭐

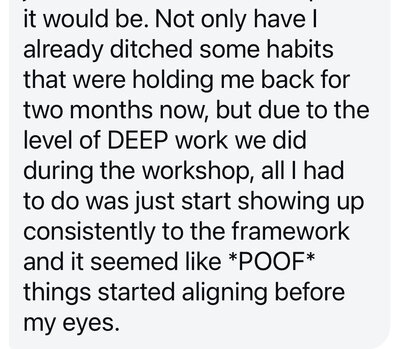

⭐⭐⭐⭐⭐

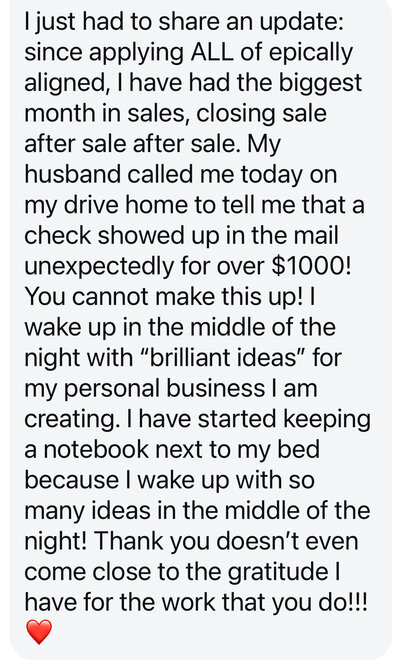

⭐⭐⭐⭐⭐

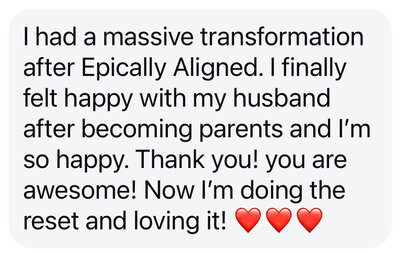

⭐⭐⭐⭐⭐